Banking technology startup 10x Future Technologies has landed $187 million in Series C funding to expand its cloud-native, API-based core banking offering. Funds led by BlackRock and CPP Investment co-led the round, London-based 10x said on June 16, as the company eyes aggressive growth after a bumpy first few years.

The company, founded in 2016 and led by former Barclays CEO Anthony Jenkins, offers a banking platform on a SaaS basis designed to help existing banks innovate faster, reduce TCO, and become more responsive to customers (many are currently stymied in terms of flexibility by a reliance on legacy code and hardware). It is also targeting those seeking to build digital challengers at pace and offer Banking-as-a-Service to clients.

(As BIAN's Hans Tesselaar recently told The Stack the need for digital transformation across the banking sector remains great: “Nine out of 10 banks are still old, established institutions. They are early adopters of automation, but they also have something from every era in IT in their IT landscape, COBOL, C++, Fortran… [Yet] they increasingly need to interact on a broader array of functions and develop new services.”)

See also: Why BIAN’s “bank on a page” approach looks prescient.

“Our investors are focused on industries that are going to be transformed by technology and companies that will be dominant players in that space,” said Jenkins. “We look forward to scaling our business in delivering the cutting-edge approach our clients need to transform the way they enable their customers to bank, pay, buy and borrow.”

Leon Pedersen, MD and head of thematic investing, CPP Investments added in a release: “10x is very well placed to change how big banks are built and deliver for their customers."

He added: "10x presents an attractive opportunity for a long-term investor like CPP Investments as we believe they will benefit from their exposure to the structural growth trend of financial institutions investing in digital initiatives and renewing core technology infrastructure, allowing banks to introduce new offerings and products much faster than using legacy platforms.”

Like most startups, it's not been all plain sailing. Nationwide planned to start using 10x Future Technologies to power a new business banking proposition but pulled the plug on the expansion after rate cuts (the company is still working with 10x) and as recently as November 2020 Jenkins was telling interviewers that the company would not be raising more money soon.

See also: Standard Chartered's Group CIO Michael Gorriz on going all-in on the cloud

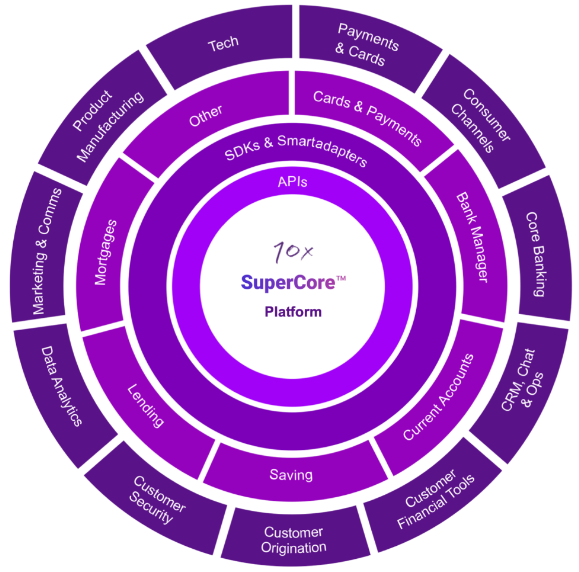

With the funding round apparently oversubscribed, Australia's WestPac however preparing to launch a BaaS platform powered by 10x's "SuperCore", and the five-year-old business having "recently begun working with a major bank in an additional geography to deliver a greenfield transformation project" appetite is clearly there among investors to help the company double-down on its offering and scale up.

(The 10x SuperCore system is predominantly written in Java and uses CockroachDB distributed SQL database, according to a late 2020 write-up by Martin Whybrow of NextGen Core Banking Solutions. It supports ISO20022 payment message flows and comes with Kafka feeds baked in to its architecture for real-time transaction visibility.)

10x Future Technologies said it will use the funding to support its expansion plans into new markets, including North America, as well as further investment into the development of its platform. It has the bold aim of supporting one billion banking customers within 10 years.